| Plan Nº DGSFP | N5095 | Net Asset Value | 10.69€ | 1D Return (%) | 0.47% | YTD Return (%) | -8.79% | Valuation Date | 22/04/2025 | FUND ID | V86516846 |

INVESTMENT POLICY.

Legacy was launched in January 2016, as a long term instrument for savings, an as a complement to the public pension scheme. It’s an individual and independent (not bank related) Pension Fund, and has the vocation to be a reference for people who want to save along the years while they are working, via periodical instalments or one time annual investments, relying for this aim on a proffessional team of proven trackrecord: Cross Capital and Caser Pensiones.

As a Pension Fund, its destinated to cover some contingencies, basically the retirement, but also the incapacity, the dependency and death. In addition, it covers special situations of lack of liquidity, as long-term unemployment and severe disease.

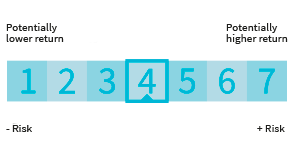

We apply an investment approach that allows the investor taking benefit from the macroeconomic trends, using a methodology proven during more than 15 years, which’s fundamental value comes from the strategic and tactical asset allocation. It has a moderate risk profile and can invest up to 100% of it’s assets in equity, domestic and/or international. The rest of the assets could be invested in fixed income, corporate or public, directly or via mutual funds and/or ETFs (Exchange Traded Funds).

Geographically, the investments are based in OCDE countries. The currency exposure to Non-Euro could reach a maximum of 75% of the assets. The objective is capital preservation and to achieve in a consistent pace an absolute return performance of 5% annual in the medium term.

We apply a rigorous risk control: there is a limitation in the exposure to high yield debt to 5 years duration, out of a total duration for the fixed income arm up to 10 years. Derivatives are used basically for hedging purposes.

We recommend investor an investment horizon higher than 5 years.

It’s not a benchmark driven portfolio management, due to it’s absolute return objective, fixed in 5% annual.

MAIN FEATURES.

| Invesment Advisor (RIA) | Cross Capital |

| Inception Date | 01-01-2016 |

| Ticker (Bloomberg) | N5095 SM |

Fees

|

1,50% Annual |

| Minimum Invesment | 60 € |

| Depositary | CECABANK |

NET ASSET VALUE (NAV).

PERFORMANCE.

| Annual | January | February | March | April | May | June | July | August | September | October | November | December | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2023 | 1,54% | 1,55% | 0,25% | -1,32% | 0,06% | -0,63% | 0,16% | 1,53% | |||||

| 2022 | -8,71% | -1,69% | -1,00% | 1,09% | -0,87% | -0,73% | -3,93% | 1,90% | -0,59% | -3,10% | 1,22% | 0,65% | -1,81% |

| 2021 | 8,41% | 0,91% | 1,30% | 1,4% | 0,43% | 0,37% | 1,12% | 0,28% | 1,03% | -0,73% | 1,06% | -0,65% | 1,62% |

| 2020 | 0,11% | -0,01% | -2,87% | -8% | 3,4% | 1,68% | 0,69% | 0,01% | 1,63% | -0,88% | -0,77% | 4,51% | 1,30% |

| 2019 | 11,98% | 3,97% | 1,90% | 1,08% | 2,20% | -2,69% | 2,47% | 0,72% | -0,51% | 0,73% | 0,10% | 1,01% | 0,57% |

| 2018 | -9,92% | -0,53% | -0,36% | -2,00% | 0,81% | -0,29% | -0,64% | 1,38% | -0,21% | 0,32% | -4,42% | -0,4% | -4,32% |

| 2017 | 4,33% | 0,27% | 1,46% | 0,78% | 0,77% | 0,36% | -1,04% | 0,16% | -0,18% | 0,94% | 1,33% | -0,60% | 0,02% |

| 2016 | 1,41% | – | – | – | -0,01 | -0,11% | -0,02% | 1,73% | 0,37% | -0,31% | -0,59% | -0,76% | 1,13% |

*Data as of 31 july 2023

| Annual | January | February | March | April | May | June | |

|---|---|---|---|---|---|---|---|

| 2023 | 1,54% | -1,55% | 0,25% | -1,32% | 0,06% | -0,67% | 0,16% |

| 2022 | -8,71% | -1,69% | -1,00% | 1,09% | -0,86% | -0,73% | -3,93% |

| 2021 | 8,71% | 0,91% | 1,30% | 1,40% | 0,43% | 0,37% | 1,12% |

| 2020 | 0,11% | -0,01% | -2,87% | -8% | 3,4% | 1,68% | 0,69% |

| 2019 | 11,98% | 3,97% | 1,90% | 1,08% | 2,20% | -2,69% | 2,47% |

| 2018 | -9,92% | -0,53% | -0,36% | -2,00% | 0,81% | -0,29% | -0,64% |

| 2017 | 4,33% | 0,27% | 1,46% | 0,78% | 0,77% | 0,36% | -1,04% |

| 2016 | 1,41% | – | – | – | – | -0,11% | -0,2% |

| July | August | September | October | November | December | |

|---|---|---|---|---|---|---|

| 2023 | 1,53% | |||||

| 2022 | 1,90% | -0,59% | -3,10% | 1,22% | 0,65% | -1,81% |

| 2021 | 0,28% | 1,03% | -0,73% | 1,06% | -0,65% | 1,62% |

| 2020 | 0,01% | 1,63% | -0,88% | -0,77% | 4,51% | 1,30% |

| 2019 | 0,72% | -0,51% | 0,73% | 0,10% | 1,01% | 0,57% |

| 2018 | 1,38% | -0,21% | 0,32% | -4,42% | -0,40% | -4,34% |

| 2017 | 0,16% | -0,18% | 0,94% | 1,33% | -0,60% | 0,02% |

| 2016 | 1,73% | 0,37% | -0,31% | -0,59% | -0,76% | 1,13% |

*Data as of 31 July 2023

RISK AND RETURN.

| Performance | Annual Return | |

|---|---|---|

| 1 month | 1,53% | – |

| 3 months | 1,01% | – |

| 12 months | -2,17% | -2,17% |

| 3 years | 6,39% | 2,09% |

| 5 years | 2,73% | 0,54% |

| Since inception | 7,39% | 0,99% |

| Annualized Volatility (d) | Sharpe Ratio |

|---|---|

| 6,02% | 0,54 |

| Maximum Drawdown (12m) | VaR (95%/1m) |

| -5,51% | 2,68% |

PORTFOLIO DETAIL.

TOP HOLDINGS

| Fundsmith Equity Fund-T Acc | 9,70% |

| Dws Concept Kaldemorgen-Lc | 7,49% |

| Ruffer Sicav-Tot Ret In-Oec | 6,93% |

| Magallanes Value Europn Eq-I | 6,87% |

| Heptagon Yacktman Us Eq-Ie A | 6,76% |

| Cob Lx Sic-Cob Interna-Paeur | 6,67% |

| Lazard Credit Opportunit-C | 6,25% |

| Tikehau 2025-F Acc | 5,05% |

ASSET CLASS BREAKDOWN

RENTA VARIABLE

RENTA FIJA

A. MONET.

ALTERNATIVOS

28,29% MONEY MARKETS

36,95% FIXED INCOME

34,76% EQUITY

0,00% ALTERNATIVES

GEOGRAPHICAL DISTRIBUTION

ENERGIA

FINANZAS

C. ESTABLE

C.DISCRECIONAL

INDUSTRIALES

MATERIALES

SALUD

INFRAESTRUCT.

TECNOLOGÍA

TMT

25,88% NORTH AMERICA

1,93% SOUTH & CENTRAL AMERICA

62,60% WESTERN EUROPE

5,33% ASIA PACIFIC

1,55% EASTERN EUROPE

0,13% CENTRAL ASIA

2,17% AFRICA / MIDDLE EAST

0,41% SNAT

HOW TO INVEST.

To invest in the Pension Fund, you can download the following documents and, once filled and signed, please send them (2 copies) together with your ID Card to the Headquarter Offices of Cross Capital EAFI, S.L. (C/ San Clemente, 24, 4ª planta, 38002 Santa Cruz de Tenerife). If you are already a Cross Capital client, it’s not necessary to fill the Individuals Questionnaire, either the ID.

1) Incorporation Bulletin

2) Individuals Questionnaire

Investment

The Incorporation Bulletin contains the data needed for the first time investment in the Pension Fund, and will only require the documents above mentioned. Once filled and signed, please send them (2 copies) together with your ID Card to the Headquarter Offices of Cross Capital EAFI, S.L. (C/ San Clemente, 24, 4ª planta, 38002 Santa Cruz de Tenerife). If you are already a Cross Capital client, it’s not necessary to fill the Individuals Questionnaire, either the ID. CASER will debit your account provided in the Incorporation Bulletin with the amount invested.

Transfer

For the transfer of your consolidated rights, it’s necessary to be incorporated to the Pension Fund (please read the Incorporation Bulletin). In addition, you’ll have to fill and sign the Transfer Bulletin. Once filled and signed, please send them (2 copies) together with your ID Card to the Headquarter Offices of Cross Capital EAFI, S.L. (C/ San Clemente, 24, 4ª planta, 38002 Santa Cruz de Tenerife). To avoid difficulties, we recommend you to provide us with an official statement of the Pension Fund to be transferend. Cross Capital will take care of the process through CASER.

IF YOU NEED FURTHER INFORMATION, WE’LL GIVE YOU A CALL.

Please introduce your phone number so we can give you a call. Office hours: from Monday to Friday, from 8.30h am to 19.30h pm (GMT).